Property Tax Macon County Nc. Tax bills for real and personal property are mailed to. explore macon county, nc tax records. records that may be obtained at the mapping office includes property cards, parcel maps and county maps terminals are also. the median property tax in macon county, north carolina is $662 per year for a home worth the median value of $167,800. Find property tax details, public records, and document retrieval services. property taxes are due and payable september 1, of the current year and interest begins on january 6 of the following year at a rate of 2% and increases by 3/4. To ensure historical data, it is best to search by township/map/parcel. Search by name, account, bill number, parcel id or address. Information on real & personal property. © 2010 macon county, north carolina 5 west main street • franklin, nc 28734 phone:

from www.formsbank.com

the median property tax in macon county, north carolina is $662 per year for a home worth the median value of $167,800. explore macon county, nc tax records. Search by name, account, bill number, parcel id or address. Find property tax details, public records, and document retrieval services. To ensure historical data, it is best to search by township/map/parcel. Tax bills for real and personal property are mailed to. records that may be obtained at the mapping office includes property cards, parcel maps and county maps terminals are also. Information on real & personal property. property taxes are due and payable september 1, of the current year and interest begins on january 6 of the following year at a rate of 2% and increases by 3/4. © 2010 macon county, north carolina 5 west main street • franklin, nc 28734 phone:

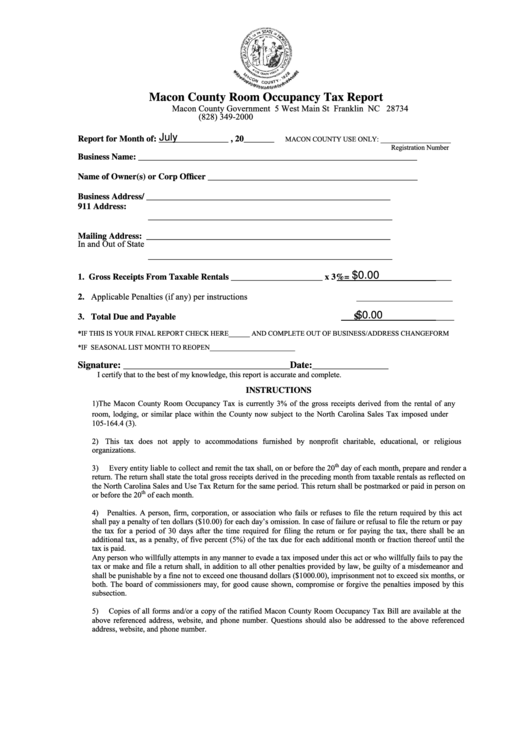

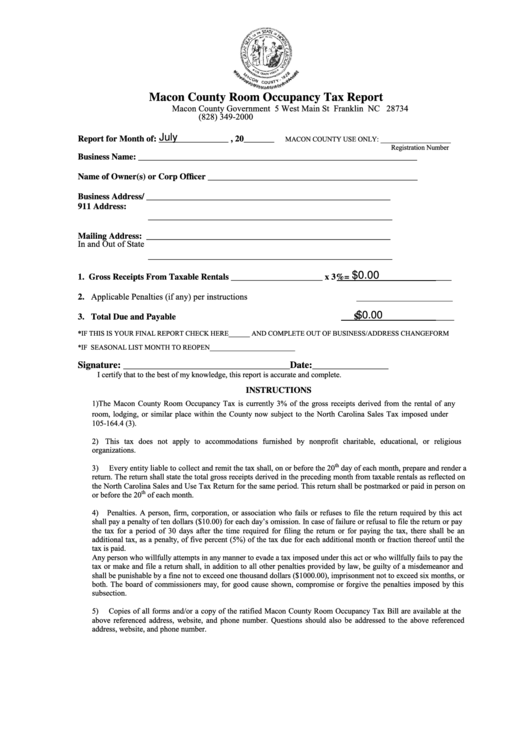

Fillable Macon County Room Occupancy Tax Report Form printable pdf download

Property Tax Macon County Nc Find property tax details, public records, and document retrieval services. Search by name, account, bill number, parcel id or address. the median property tax in macon county, north carolina is $662 per year for a home worth the median value of $167,800. records that may be obtained at the mapping office includes property cards, parcel maps and county maps terminals are also. Tax bills for real and personal property are mailed to. Find property tax details, public records, and document retrieval services. property taxes are due and payable september 1, of the current year and interest begins on january 6 of the following year at a rate of 2% and increases by 3/4. Information on real & personal property. © 2010 macon county, north carolina 5 west main street • franklin, nc 28734 phone: To ensure historical data, it is best to search by township/map/parcel. explore macon county, nc tax records.